TLDR:

Markets sold off on JPOWs hawkish comments on the heels of triple witching as expected.

JPOW doesn’t go brrrrr anymore but my positions do.

Big fork in the road for directional bias into Dec this week

Vanna is more than a pretty face on Wheel of Fortune

I might sell all my shorts and flip long…..barf

Feel free to join the chat. I’ll be posting more frequent thoughts and answering questions there.

Week 13 Recap

Once again I got lazy and started to draft last weeks post but didn’t finish so I’ll just pick it up where I left off at Week 14 update. Almost everything in the Week 13 recap was written on the 17th.

In my last post I made the comment below as my most likely scenario to play out as a result of triple witching:

What happened? $SPX closed at 4450.33

This was a great example of the underlying financial physics playing out. We saw the economic prints come in as forecasted and as a result, option dealers unwound their hedge. In this case they had accumulated a long hedge against their short calls (customers had been buying calls).

Worth noting though is that it appears the dealers were delta flat the day before triple witching (see red arrow below).

If true, it would mean most of this move lower was dealers initiating new short positions to hedge their short puts (customers buying longer dated put options).

Either way it doesn’t really matter. What matters is the underlying flows were still confirming weakness.

Week 13 Account Update: +36%

Despite the heavy sell off on Friday from Triple Witching, I haven’t made a ton of new moves. I’m positioned where I want to be with the core position of +5,000 shares of SOXS 0.00%↑ at an average price of $9.40.

For new subscribers or otherwise uninitiated, SOXS is a triple leveraged inverse ETF which tracks the semiconductor market. In other words, as semiconductor names like NVDA 0.00%↑ AMD 0.00%↑ AVGO 0.00%↑ INTC 0.00%↑ MU 0.00%↑ fall, this ETF goes up 3x.

Week 14 Recap

Since Friday 9/15 Triple Witching, the S&P is down another 3% (>4% since the morning of Triple Witch).

This sell off was sparked by the Fed interest rate decision and subsequent press conference where Jerome Powell basically said “higherer for longerer”. The markets had previously priced in 3 rate CUTS this year and now they don’t show a rate cut until next year.

JPOW continues to play chicken with the market and doesn’t appear phased in the slightest. He knows and we know the only thing to fix this situation is a hard landing but he’s been playing a psyop to break the news gently. Remember when inflation was transitory? Or just “two weeks to slow the spread”…..Yeah this isn’t a new tactic.

Like I wrote in the prior weeks recap, I expected dealer flows to bring us lower as they short the market to hedge the puts they were selling. With dealers having effectively a clean slate, it made for a significant week of selling as swing longs either took profit or stopped out at Aug 18 lows.

We closed Friday VERY weak with a fast cover rally that got absolutely HAMMERED at VPOC (volume point of control….more on this in a dedicated future post on market profile).

Week 14 Account Update: +46%

Still no major positional changes, I’m sitting where I want to be with a good average on SOXS and my XLK puts working. UVXY is up 17%. Hell the SOXS position is up 26% alone! If we really do snap the SOXS position will likely make 1,000% over the next two years.

Next Week (9/25-9/29)

It’s been nearly 4 months since my first post on this Substack June 18, 2023 where I called for a market top here:

As usual I was early and in hindsight it was rather obvious that I was too early. I had to endure some pain trades and take some repositioning cuts along the way but such is trading. You have to manage risk. That being said, I stuck to my thesis and it paid off.

It’s worth noting that being early can be just as bad as being wrong, especially on the short side. Note my initial call on June 18 is nearly the EXACT same price as the close of Friday 9/15. That was 3 months of sideways pain and theta burn to endure. Granted, I made some money along the way riding the moves but still: Patience is key.

So what now? Double or triple down? Go all in? I mean, if this isn’t the complacency stage the I don’t know what is.

I might. At the same time if this is really the start of a huge move lower, there’s no need to be the first and get trapped into a massive short squeeze.

I plan to watch the early part of next week to gauge sentiment. We’re due for a technical bounce but does that bounce get sold into hard?

Looking at the weekly chart below, we’re sitting at the 50 week moving average which happens to be the daily 200MA as well - a typically strong support level. We’re also pulling back into a large volume node shown in red.

This is where I bring back up the dealer flows. I believe dealers were hedged flat into Triple Witching (i.e. the size of their hedge was very small). Since then, they have shorted the market HARD as long term bulls exited the 9/15 call options and huge put buying came in last week.

But keep in mind: the same hedging that brought us down, can just as quickly bring us up. Except this bounce hedging flow would be covering flows and could spark a massive BTFD moment and scare the shit out of bears. Why?

Vanna

Recall from my dealer hedging post that Vanna is the rate of change of Delta for changes in implied volatility. All things equal (even if a stock goes sideways) if IV drops a delta hedged short gamma position will require BUYING back the underlying (delta buyback).

If I sell you a put option and the underlying doesn’t move then that fixed strike vol (volatility) will drop. This drop in vol will decay the value of the option, requiring me to remove some of my short hedge through covering the underlying I shorted initially.

So why would people sell volatility right now? Structured Products.

Structured Products

With market outlook growing increasingly pessimistic, investors are looking for ways to maintain returns and minimize risk. This has brought about a massive influx of structured products.

These products essentially move client money into T-Bills (which are riskless) to take advantage of the high yields (5% right now). At the same time, they are able to use the T-bill as cash collateral against short options for further yield (research yield stacking). We even have ETFs like QQQY that sell puts and there are many more like it.

These products/strategies have been suppressing vol to a point we haven’t seen for a few years. There is an abundance of vol supply. Hell, in my other accounts I’ve been killing it selling TSLA put spreads. It never been easier to sell options.

So without any major macro catalyst and with so much vol supply, I’m not sure we continue much lower. We do have student loan forgiveness set to expire in October. The housing market is showing serious signs of deterioration. More than 60,000 realtors have left the business in the first half of the year alone. Mortgage rates will only continue to rise. But we haven’t had an OH SHIT moment. A truly scary market snap where we lose 5% in a day.

If we don’t have that moment next week then you can expect IV to contract, bears to cover, bulls to FOMO and IV to get crushed. And what affects the delta hedging rate with respect to IV? Vanna. We’ve come full circle.

Below we see dealer delta and vanna exposure by expiration. Notice 10/20/23? That is the next monthly options expiration. Dealers have negative delta (long puts or short calls) and negative vanna (vanna is negative for puts).

There is nearly $5 billion in delta (underlying) buy back tied to IV alone. This could spark a massive rally in my opinion. One that may last into year end flows where seasonality (santa claus rally) create a positive feedback loop of final euphoria. There are other structural flows that would occur in the first of January where monthly opex and VIX expiration could create a stars aligning scenario for a massive rug pull.

In fact, depending on the bounce next week, I may exit all my short positions and flip long through end of the year.

Bullish Trade Ideas

If we do bounce, hold and begin to push higher I’ll be looking at these bullish plays:

SPY 10/20/23 $450C

Major indices are sitting on big support and rising daily 200 period moving averages. If we hold and bounce SPY will be the first thing people flock too and I think we’ll see a fast rip back to the wedge breakdown.

Target (TGT) Jan 19 2024 $120C

If we see a market bounce on strength and begin to push higher, I could see beaten down retail names like Target see a nice reversal heading into holiday season. Note earnings are coming up on November 6th.

PayPal (PYPL) Dec 15 2023 $60C

If markets hold this recent sell off and bounce, I think lending names like PYPL will bounce on optimism that maybe the situation isn’t as bad as we think and they could potentially benefit from higher interest rates and consumers opening new accounts heading into holiday season.

Bearish Trade Ideas

If Armageddon is indeed upon us I will likely buy longer dated puts on big names and shorted dated calls on volatility.

VIXY 10/20/23 $30C

Eli Lilly & Co (LLY) 01/19/24 $550P

I’m cheating a bit here since I currently hold the $570P for this expiry in another account that I bought on 9/15/23. This name ran 400% from Covid lows to recent highs in a classic gamma squeeze. I think we’ll see the generic version of their weight loss drug hit the market soon.

SQQQ 01/19/24 $25C

I’m still holding some 10/20/23 $30Cs in another account which has been a pain.

NVDA 01/19/24 $400P

I’ve been short on this name since before earnings and will continue to be short the name if the markets are weak.

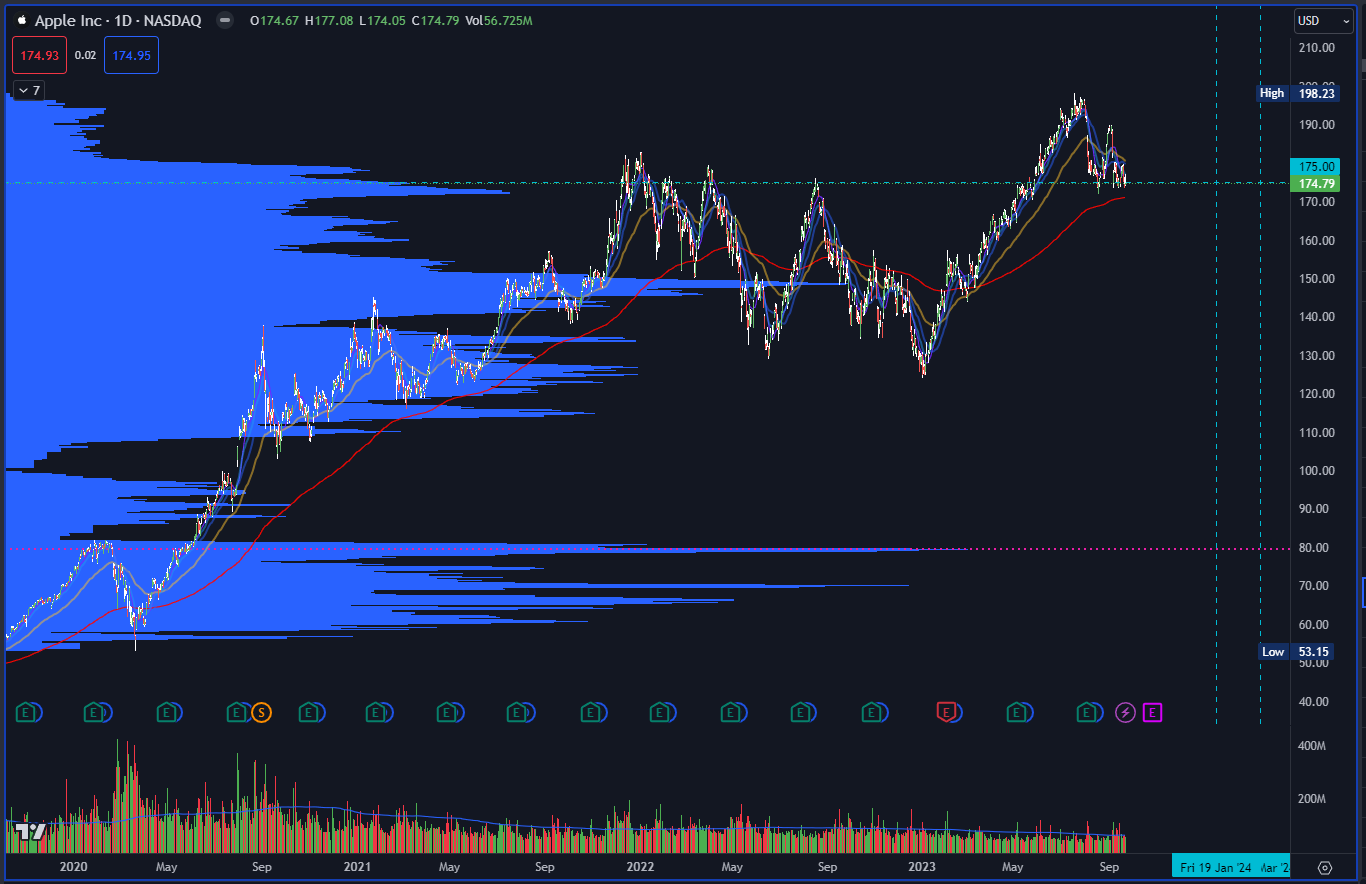

and last but not least, the stock market darling Apple AAPL 01/19/24 $175P

I think next earnings will be a terrible let down as the reality sets in that iPhone sales (which are some half the company revenue) are dropping. I think AAPL sees $120 again before it makes new highs.