Why am I getting this email?

Hey it’s Josh L. If you’re receiving this email, it’s because I know you personally and you’ve expressed interest in my thoughts or opinions on the stock market. I've decided to put out a weekly newsletter where I will discuss my general thoughts/views both short term and long term along with trades ideas which I'll log and track against a hypothetical $100,000 paper account. Not 100% sure where this will lead but I already do this every week as part of my routine so figured I might as well share.

General Thoughts/Views on the Market

On the surface, the market looks strong and bullish. However, a look under the hood tells a vastly different story. One of instability and weakness. In the last 6 months we've seen the rate of consumer inflation slow down and now decline. We've seen the rising cost of producer inputs slow down and now decline. We've seen a hot labor market slow down and now decline. The Fed announced the first pause in the rate hike cycle last week. To cap it off, Artificial Intelligence has been the most used phrase in earnings calls as companies try to do whatever they can to boost their stock price. Names like AAPL, NVDA and MSFT are at all time highs. What's not to love?

While inflation may have stopped increasing, history has proven inflation to be a sticky phenomenon whereby deflation typically only occurs due to technological advances like your big screen TV. We all know the prices our parents paid for things when they were our age. Only time will tell if consumer prices continue to decline or hold flat like core PCE.

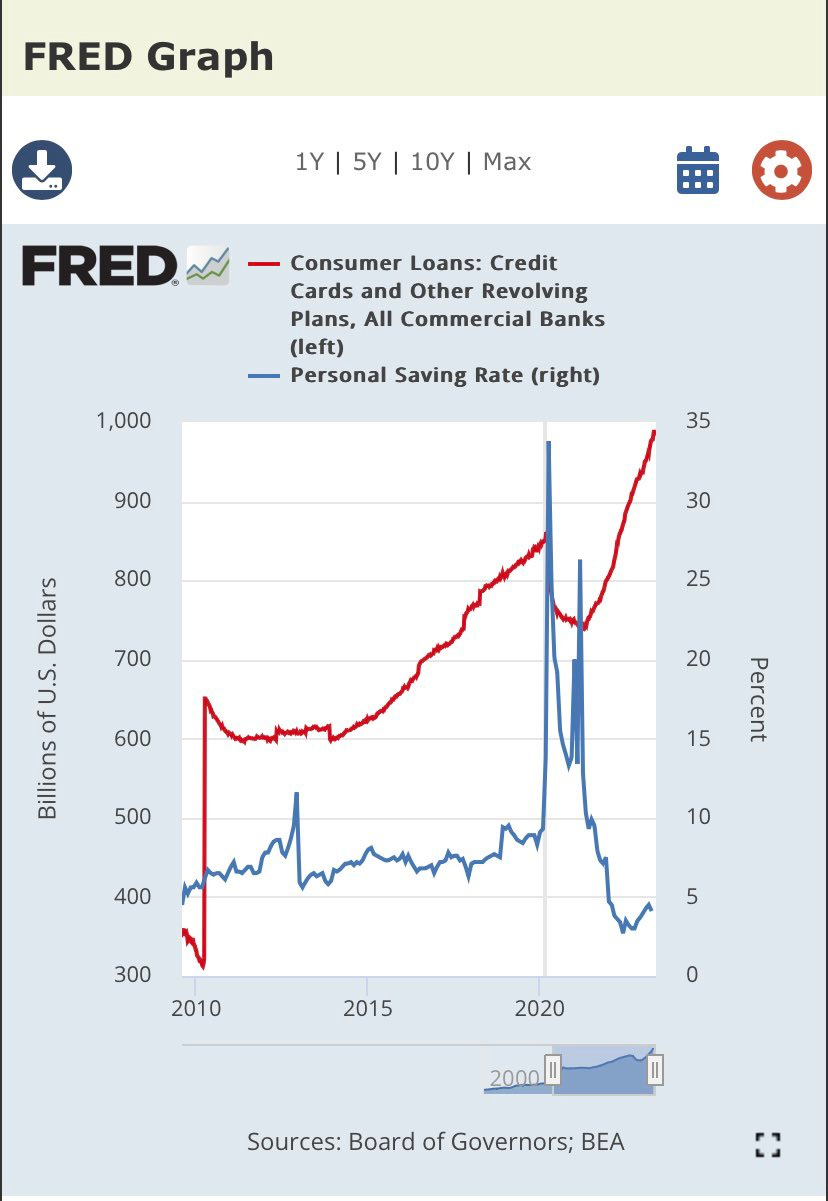

Consider this against a backdrop of all time high consumer credit card balances (with higher rates) and nearly all time lows in savings deposits.

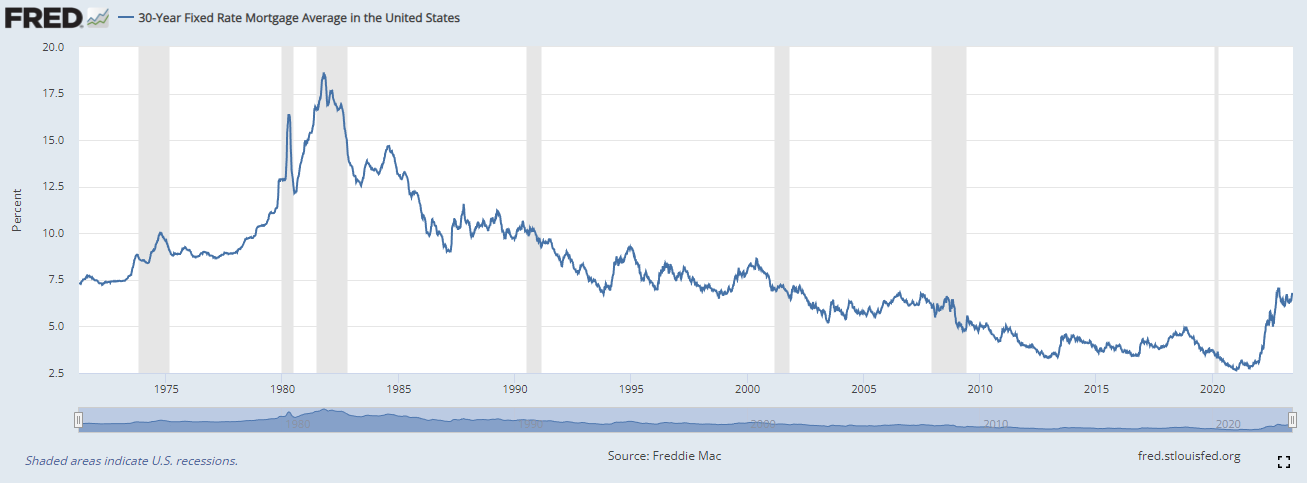

Add to that with one of the fastest and largest upticks in 30yr fixed mortgages during a period in which Americans were flush with cash and buying inflated home values. Did anyone see the recent approval of 40yr mortgages now!?

Sure, mortgage rates are nothing like the ‘80s but the fast increase will leave current homeowners stuck and potential buyers sitting on hands. Imagine the homeowner with no savings, high credit card balances and now no more job. What are their options? Sell the house and extract equity? You could, but even downsizing will require the same mortgage at current rates. Maybe take out a HELOC? Good luck with current lending standards (that would only get tighter). If we do enter a recession (which spoiler alert we’ve been in one but the Biden administration changed the definition we’ve used for the last 30yrs of consecutive quarterly declines in GDP) then home demand will plummet. Generations of homeowners have built their net worth centered around their home. In my opinion it won’t take much in the way of a recession or slowdown to kick the ant pile with so many Americans in this sort of financial situation.

Now do I think we go full blown market correction? I give it a 50% chance of a 20% correction occurring within the next 6 months. Do I think we are at the complacency stage of the figure below? 1,000,000%. Don’t think this chart is accurate? Pull up MRNA, BNTX, ARKK, FSLY, CVNA, PYPL…the list goes on.

I think we’ll see the narrative shift from inflation to recession (hard landing vs soft landing). A lot of Americans (yourself included) are probably thrilled that their 401k is back near highs but they also know the current economy, administration and political agendas are totally unaligned with traditional American values. It won’t take much for people to call their advisor and tell them to move their money out of stocks and into bonds.

So what makes now such a compelling time to become bearish on the market?

Triple Witching and Options Expiration

Derivatives such as Options used to be available only to portfolio managers to hedge their downside risk through purchasing put options. It was just simple insurance. Put options allow you to sell shares of the underlying asset at a value that is higher than the market price IF the market price is below that mutually agreed upon price (strike) within a certain time frame (expiration).

The exponential rise in options trading means the tail now wags the dog. Nowadays many people only trade the option contracts instead of the stock (ever head of GameStop or AMC)? With so much supply locked away in pensions and market liquidity at all time lows, long options have never been more attractive. They are cost effective providing 100:1 leverage and have defined risk (you can’t lose more than the premium you pay up front).

But who sells or writes the option contracts? Aside from guys like me, its mainly Option Market Makers (dealers). These dealers are required to provide liquidity to options markets on thousands of stocks across thousands of strikes and thousands of expirations. When you buy a call option, the dealer who sold it to you will buy the underlying stock (as much as 100 shares per contract) as a hedge in case price increases and they lose money on the call they sold (not quite that simple but generally correct). When it does increase, they buy more to stay dynamically hedged.

This can create a feedback loop as prices rise. This is where the term gamma squeeze comes from and is exactly what happened to NVDA on earnings just recently. Ever wonder why it stopped where it did? The answer was in the options chain. Gamma squeezes are what happened to GME AMC TSLA MRNA BNTX, etc. Now companies know if they issue a very small amount of (high priced) shares (supply), it’s easier to ignite a gamma squeeze where insiders can exit and valuations sky rocket.

So how do dealers manage their risk? They do it by dynamic hedging. They calculate their total exposure in terms of the underlying variables of the contract such as delta and gamma then use high frequency trading algorithms to continuously buy and sell the underlying asset to stay directionally neutral. Their goal is to just collect the bid-ask spread on the options with as little directional risk as possible. So, I pay a few hundred a month for option data feeds that allow me to approximate their entire book whether they are short or long options, whether its calls or puts and to what extent or magnitude (notional value). Once you know that, you just ride the waves and try not to wipe out! If you want a deep dive on this concept go to spotgamma.com. Sounds a lot different than buying Carnival Cruise Lines because Covid is over right?

What you’ve seen in the market the last few weeks was a gamma squeeze. Portfolio managers have been buying calls so they don’t miss out on any upside potential, but have been timid to buy large amounts of equities at these elevated prices. In fact, many have been reducing equity exposure at these levels.

This is where option expiration (OPEX) comes into effect. As expiration nears, prices tend to gravitate toward levels of high open interest and volume as the underlying greeks that govern option pricing go parabolic. There’s Quarterly, Monthly, Weekly and Daily OPEX depending on the instrument. Monthly opex (mOPEX) is known to cause major moves after expiration as option sellers are free to remove (sell) whatever stock they accumulated as a hedge into expiration.

Did you know the COVID crash started the Monday after the Feb21, 2020 mOPEX?

What about how the global financial crisis of ‘08 started the week after the Aug 2008 mOPEX?

Or the DotCom Bubble after Triple Witching Friday Mar 2000?

As if monthly expiration wasn’t prone to big enough moves, Quarterly expirations add fuel to the fire. This is where Triple Witching comes into play. It is the simultaneous expiration of stock index futures, stock index options, stock options four times a year. It occurs once every quarter, on the third Friday of March, June, September, and December. There used to be Quad witching but they removed single stock futures in 2000. Below is the weekly chart of the QQQ (tech sector) in the dotcom bust. Look familiar? It should, scroll up to the Psychology of a Market Cycle.

In my opinion this is the calm before the storm:

Extremely extended prices caused by blowing out short sellers (their exits provide demand as they buy back to cover the stock they borrowed and sold already)

Inflation cooling off

Hot jobs market cooling (which would make Feds less hawkish),

Hot new sector theme (AI) on the top 30% by weight S&P 500 names

Fed rate hike pause

Triple Witching which had $3T (trillion) dollars of notional value tied to options expire this past Friday. Normal is maybe a few hundred billion fwiw.

If the market doesn’t continue to buy call options or equities, the dealers will have to let go of their hedge. So why would they dump it? Why not let it down gently? When they dump the stock it causes implied volatility to sky rocket which makes put option prices higher and spreads wider (aka they make more money). Just look back at each nasty red day we’ve had since the market top. It was always preceded by a run up.

Now, in the absence of a major catalyst, we may continue to rinse repeat this move into next quarter and probably make all time highs in that scenario. But at some point the shoe will drop and the higher we go the harder it will fall. Sometime between now and October is my guess.

I may be wrong but this is what I would consider a high probability scenario to be short the market if we remain weak early next week.

Trade Ideas

All 3 trade ideas are centered on shorting over extended tech names on the heels of triple witching when markets are weakest.

Short Oracle (ORCL) - Current Price: $125

Not much to say here, just a nice squeeze.

Buy to open 10 ORCL 230721P120 $1.50

$120 put option expiring July 21, 2023

Each contract costs the premium x 100 (one contract is for 100 shares) - $1.50 x 100 = $150 per contract x 10 = $1500 total debit. If it goes to zero the most I could lose is $1500 or 1.5% of the account.

My price target by expiration is $110 which would be in the money (ITM) by $10 making the contracts worth at least $1,000 ea x 10 = $10,000 depending on how much time is left to expiration if the price target is hit (and how much implied volatility increases). I think the name sees $90 before year end.

$8500 potential profit to $1500 potential loss is a great trade (5.6:1)

Long SOXS (Inverse triple leveraged semiconductor ETF) - Current Price $10

Some of the most extended names in the market are in the semi space (NVDA, AMD, AVGO, etc) which have been propelled to dizzying heights on the AI craze. By almost every imaginable measure they are well beyond normal moves and due for a pullback. Why go long an inverse ETF you dummy? Calls are usually cheaper than puts and as you can tell, the triple leveraged products make for incredible moves. I’m still salty I was short a few thousand shares at the literal highs October 13th, 2022.

Buy to open 10 SOXS 230818C20 $0.90

$20 call option expiring August 18, 2023

Total debit: $900

Price target $25 or above

Potential profit: $4,100 (4.5:1)

Long SQQQ (Triple Leveraged Inverse ETF tracking QQQ)

Buy to open 10 SQQQ 230818C25 $0.70

$25 Call option expiring August 18, 2023

Total debit: $700

Potential profit w/ $30 target: $4,300 (6.1:1)

Best case scenario: all three reach full target would yield a 16% gain against a potential 3.1% loss. Generally speaking if the contracts see an unrealized loss of more than 50% on each, I would exit for a combined 1.5% loss.

Other names I will be watching for short entries:

PANW, ADBE, TSLA, NVDA